Netflix Subscribers Stats: How Does It Change Over the Past 2 Decades?

Summary: Netflix has experienced an annual increase in its subscriber base over the past two decades. In the presence of intense competition in the streaming service and other entertainment service sectors, how can Netflix maintain its popularity and vitality? What insights can we learn from these data shifts?

Table of Contents

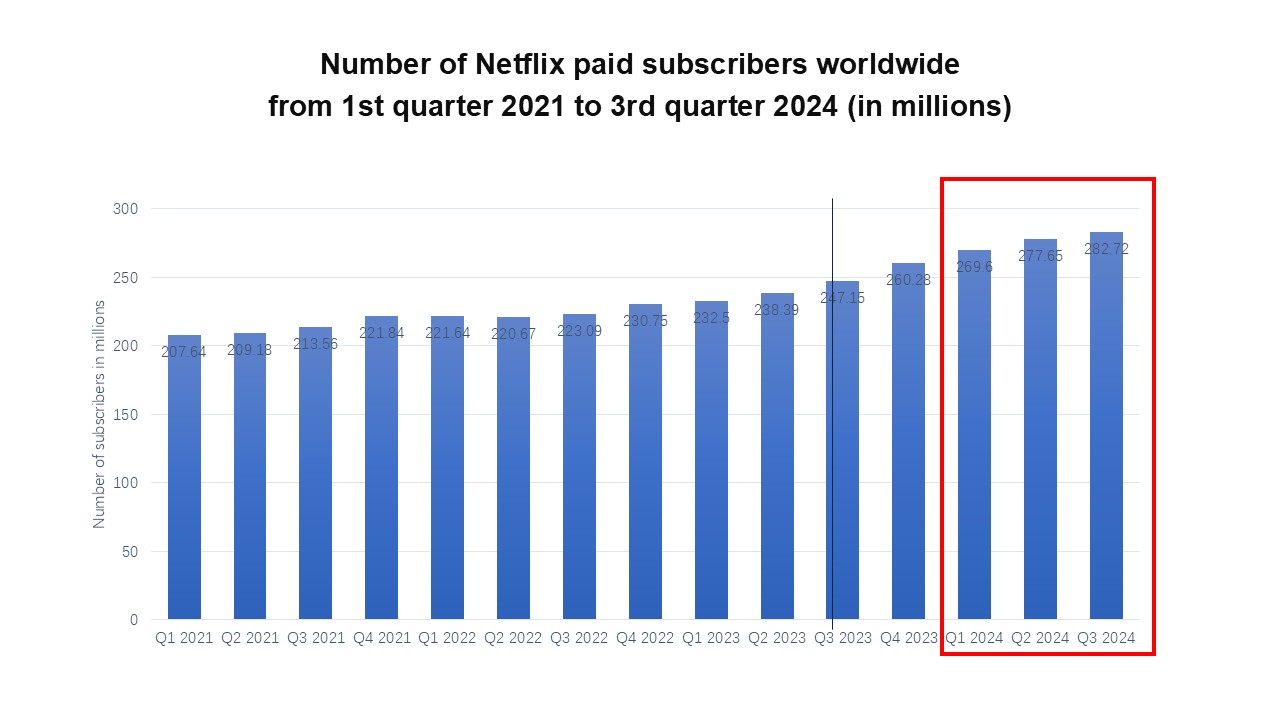

Since its founding in 1997, Netflix has grown to become a well-known streaming service provider worldwide. With over 10 million subscribers and 100,000 movie DVDs as of 2009, Netflix has been offering subscription-based services since 1999. According to data from the third quarter of 2024, Netflix's global subscriber base currently stands at over 280 million.

Netflix has experienced an annual increase in its subscriber base over the past two decades. In the presence of intense competition in the streaming service and other entertainment service sectors, how can Netflix maintain its popularity and vitality? Are there any issues reflected by the fluctuations in Netflix's subscription data? What insights can we learn from these data shifts?

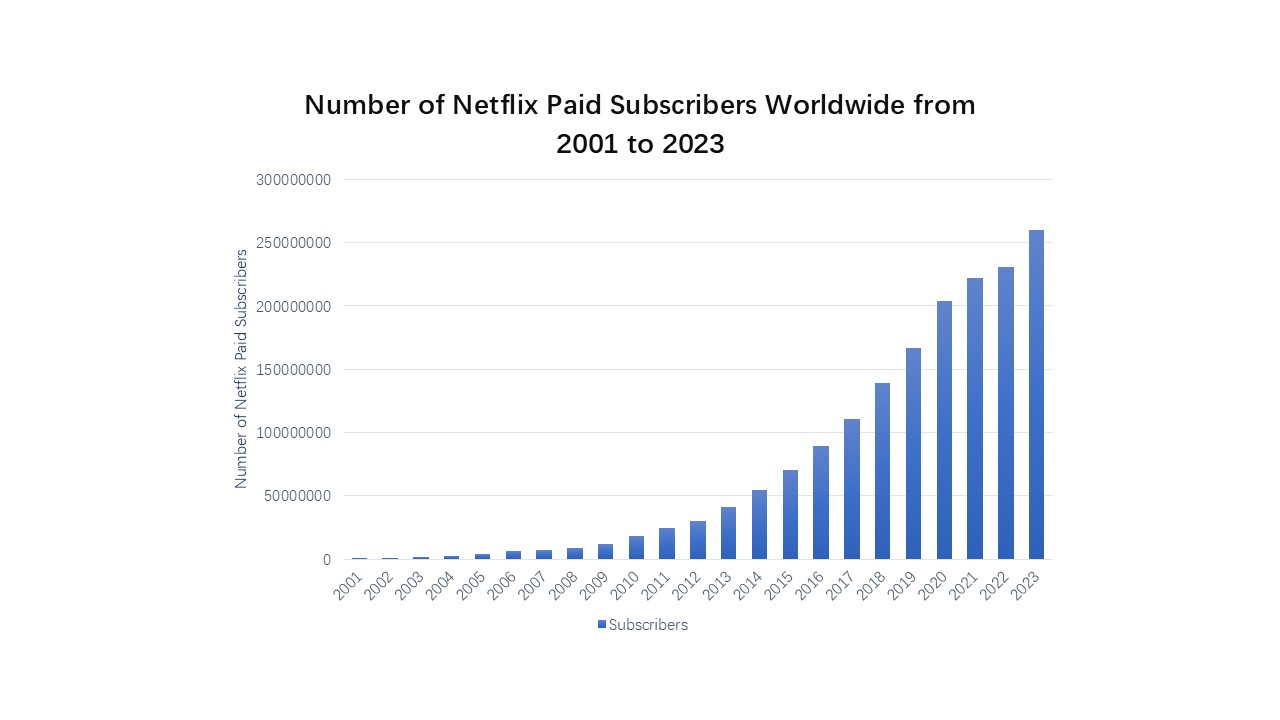

Twenty Years On: Subscriptions Keep Rising

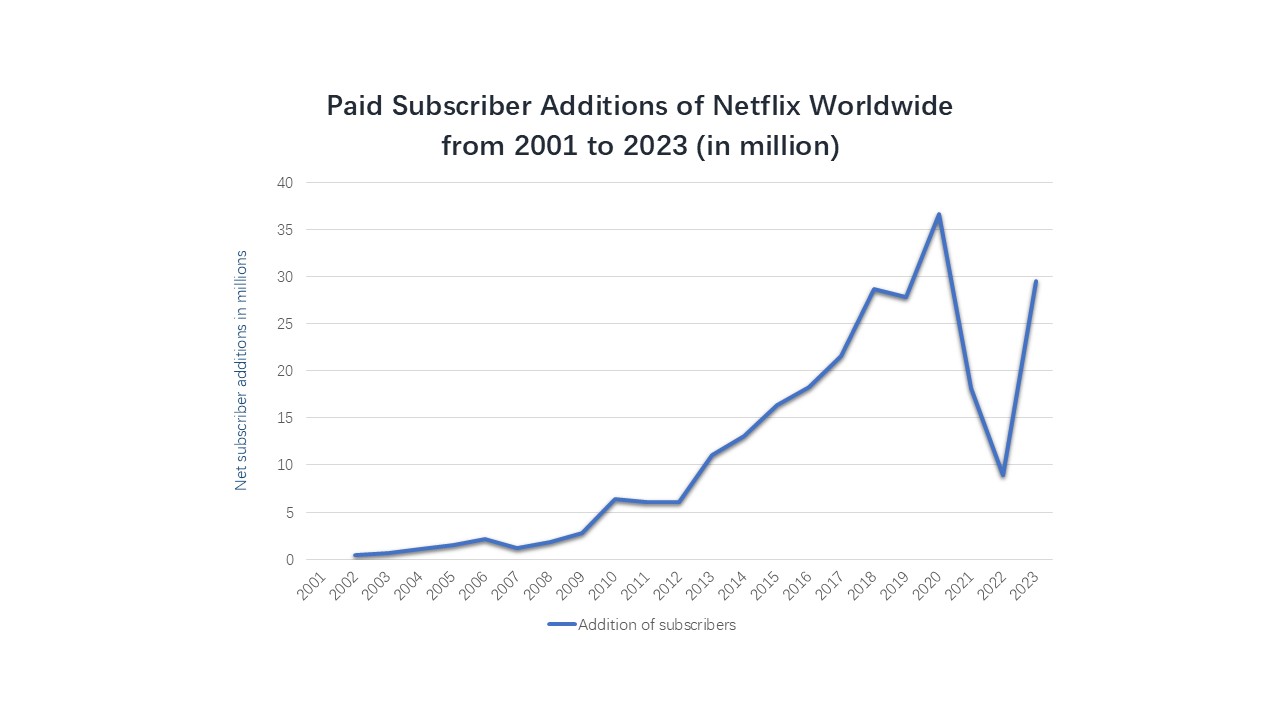

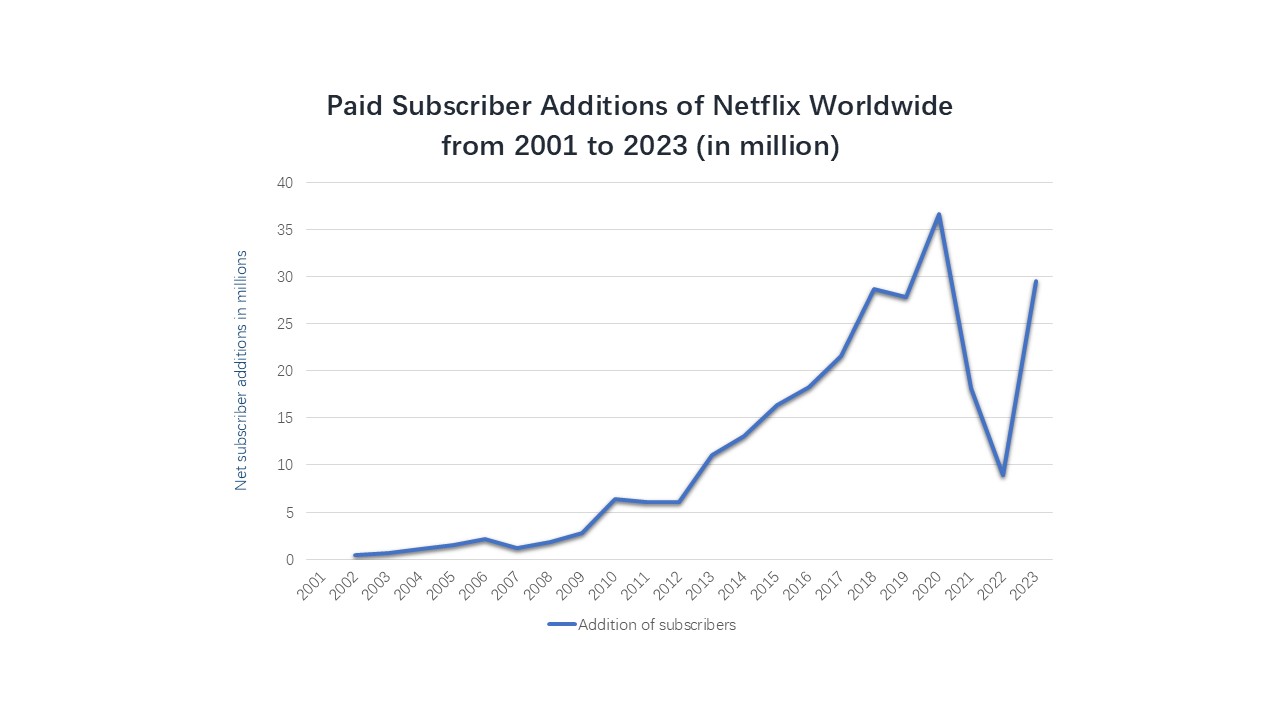

The total number of Netflix subscribers increased gradually from 2001 to 2023. The following are many essential data items to consider:

- In 2014, Netflix subscribers surpassed 50 million.

- In 2017, Netflix gained 100 million subscribers.

- In 2020, Netflix subscribers exceeded 200 million mark.

- In 2023, Netflix had over 260 million subscribers.

Among these years, an obviously quick roar has been seen on Netflix's subscriptions 2019-2020 an obviously quick roar from 2019 to 2020. This growth is known as one of the most prominent features of Netflix as a streaming media platform during the epidemic age. After 20 years, Netflix is still able to achieve sustained subscription growth. It relies on the following three main business strategies:

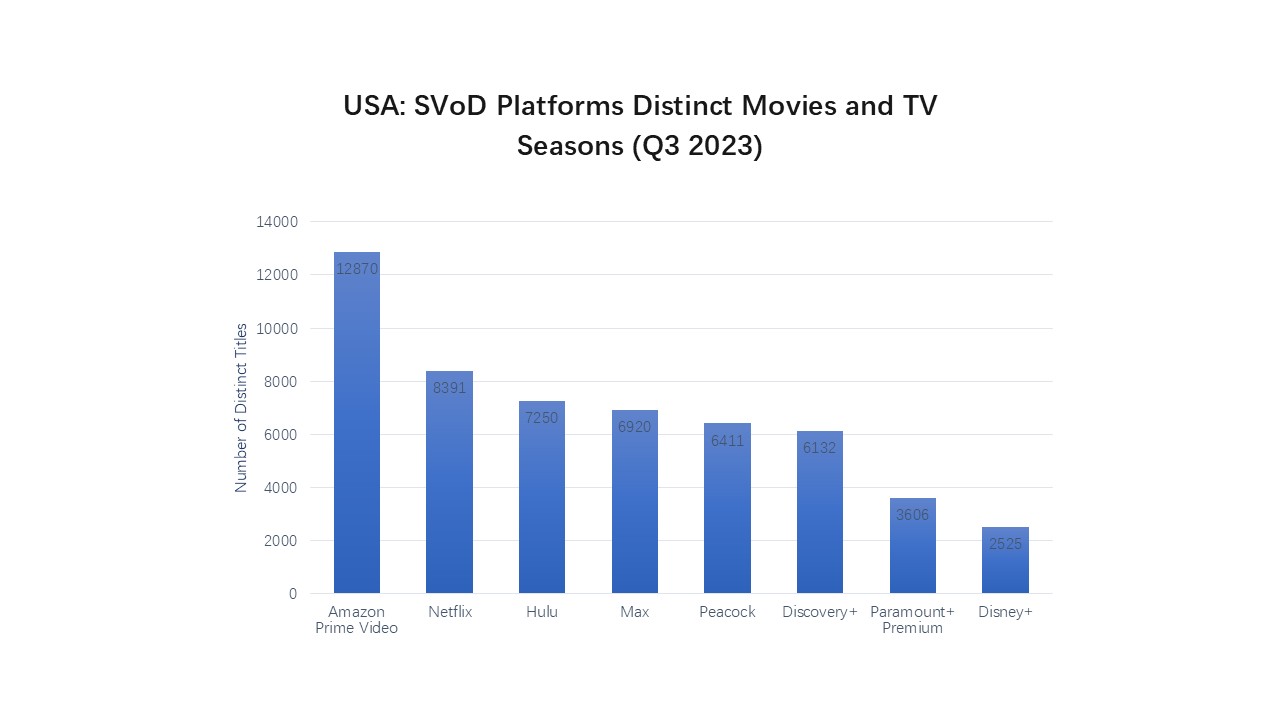

1. Vast Content Library: Offering Diverse Choices for Customers

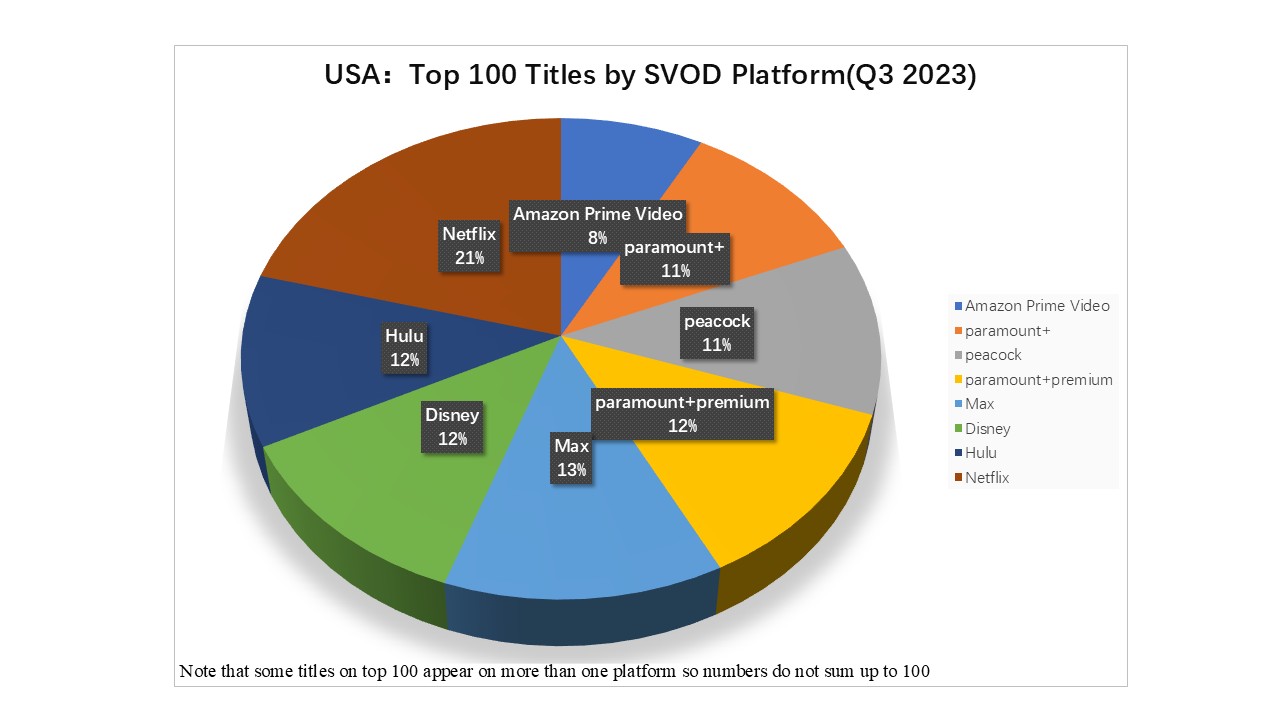

According to data from major streaming platforms in the U.S. for the third quarter of 2023, Netflix's library of 8,391 titles ranked second, well ahead of streaming services platforms such as Hulu (7,250 titles) and Disney+ (2,525 titles).

At the same time, Netflix enjoys a wider range of themes: Hulu focuses on drama and comedy; Disney+ focuses on family animation and comedy; and Netflix covers a wider range of genres, including drama, romance, adventure, music and more. Netflix's library of blockbuster movies provides customers with a wealth of free choices.

2. Successful Content Economy : Continuously Delivering High-Quality Content

Netflix has always been a major player in the content economy, offering high quality content as the primary means of attracting attention as well as increasing user loyalty.

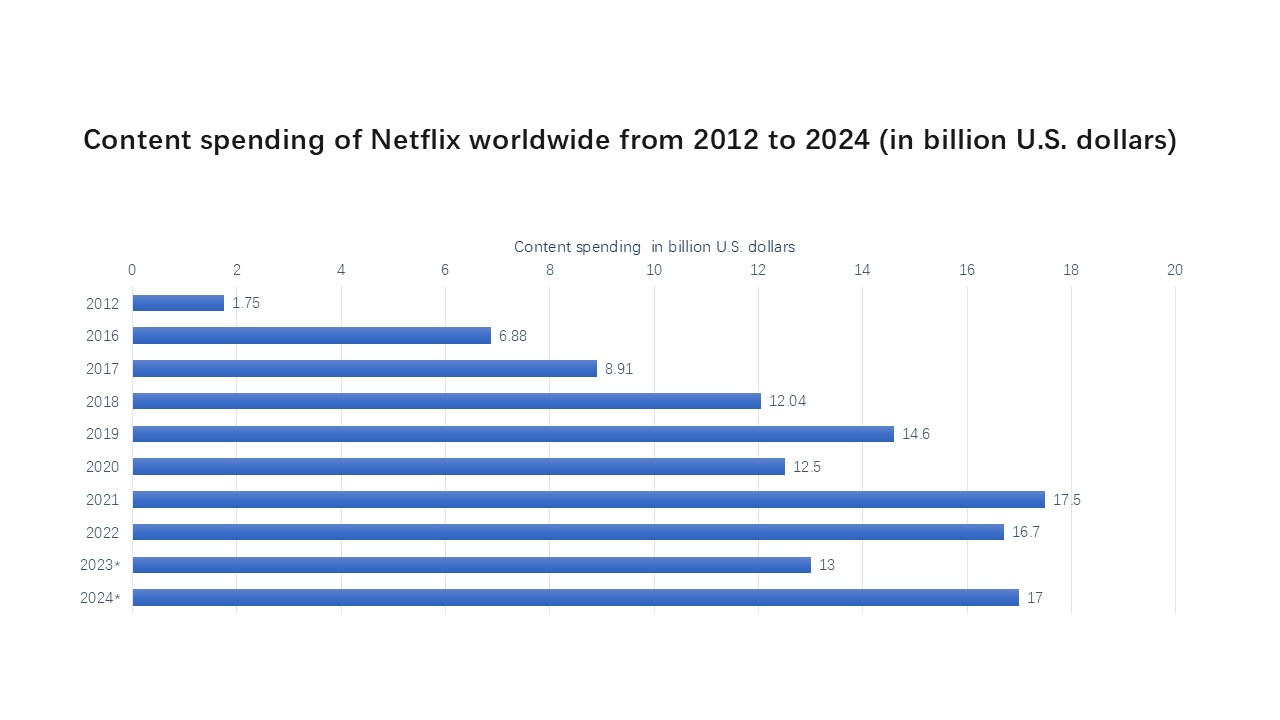

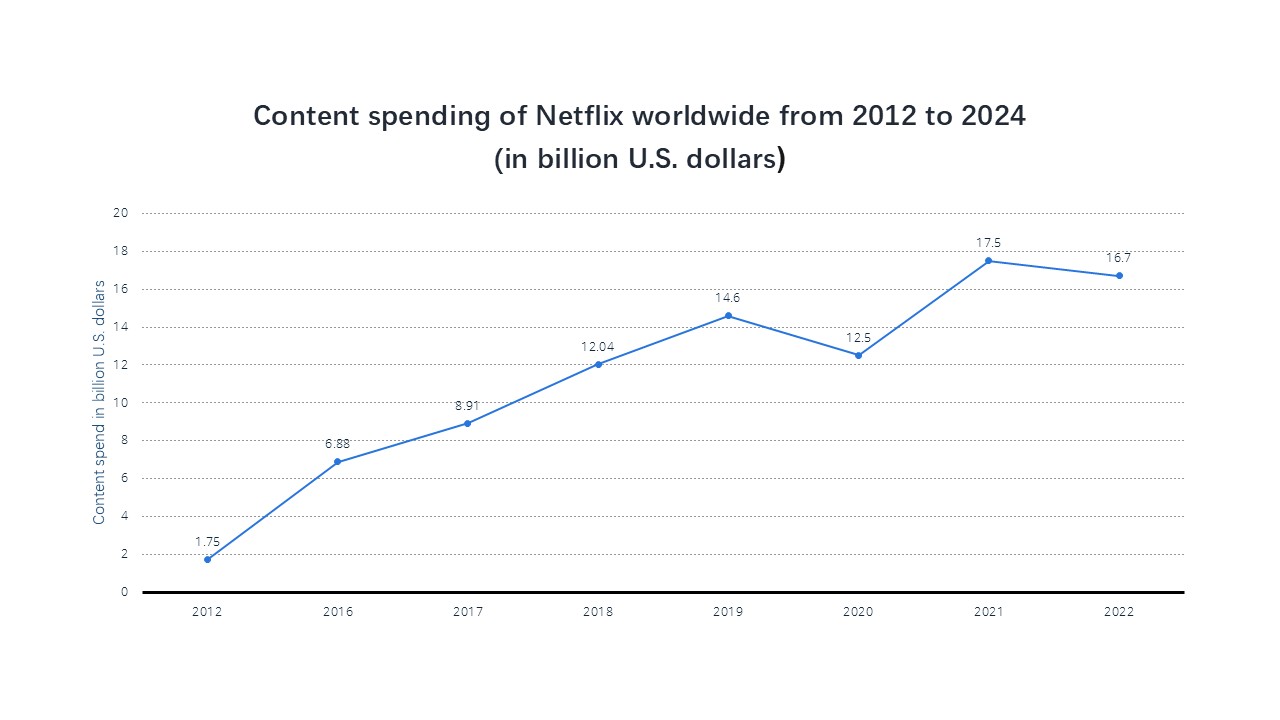

Netflix attached great importance to content investment between 2012 and 2024, constantly increasing its expenditure in this filed. In the past decade (2012–2024), content spending has almost doubled, reaching a total of $17 billion. The impacts of such substantial investments are evident: Netflix had 29 entries and was firmly at the top of the list of the Top 100 Titles in the United States in the third quarter of 2023.

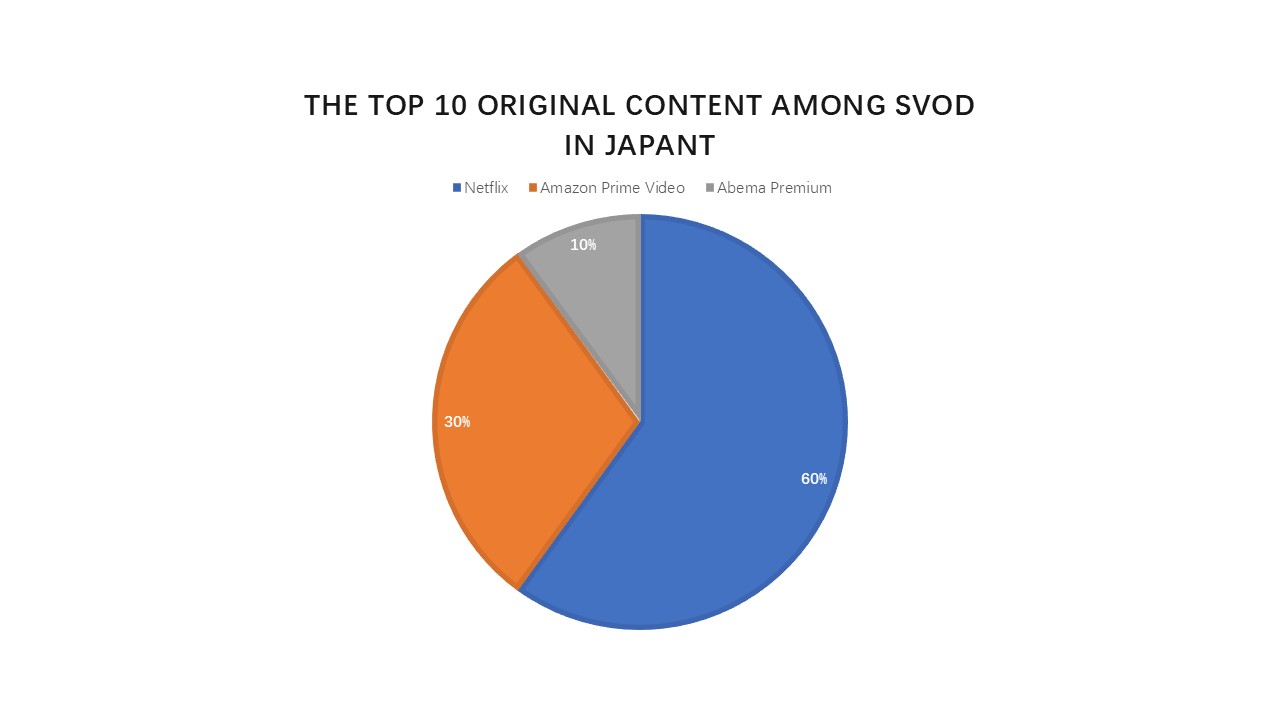

In a similar vein, as of August 2023, Netflix was the most popular original work in Japan, ranking six out of ten streaming services.

The rewards of the content economy are clear. Take Netflix's Baby Reindeer and Bridgerton as an example. According to Netflix’s letter to shareholders, it noted that the UK and India had especially strong viewership slates this year, noting that 88.4 million viewers streamed Baby Reindeer.

The international success of hits including Baby Reindeer and Bridgerton helped Netflix gain another quarter of revenue increases, as the streaming giant continued to draw in subscribers with ad-supported subscriptions and live events streaming.The largest streaming service in the world added 8 million subscribers in the latest quarter, making its total subscriber count 277.7 million worldwide. Revenue grew 17% during the quarter, reaching $9.5 billion.

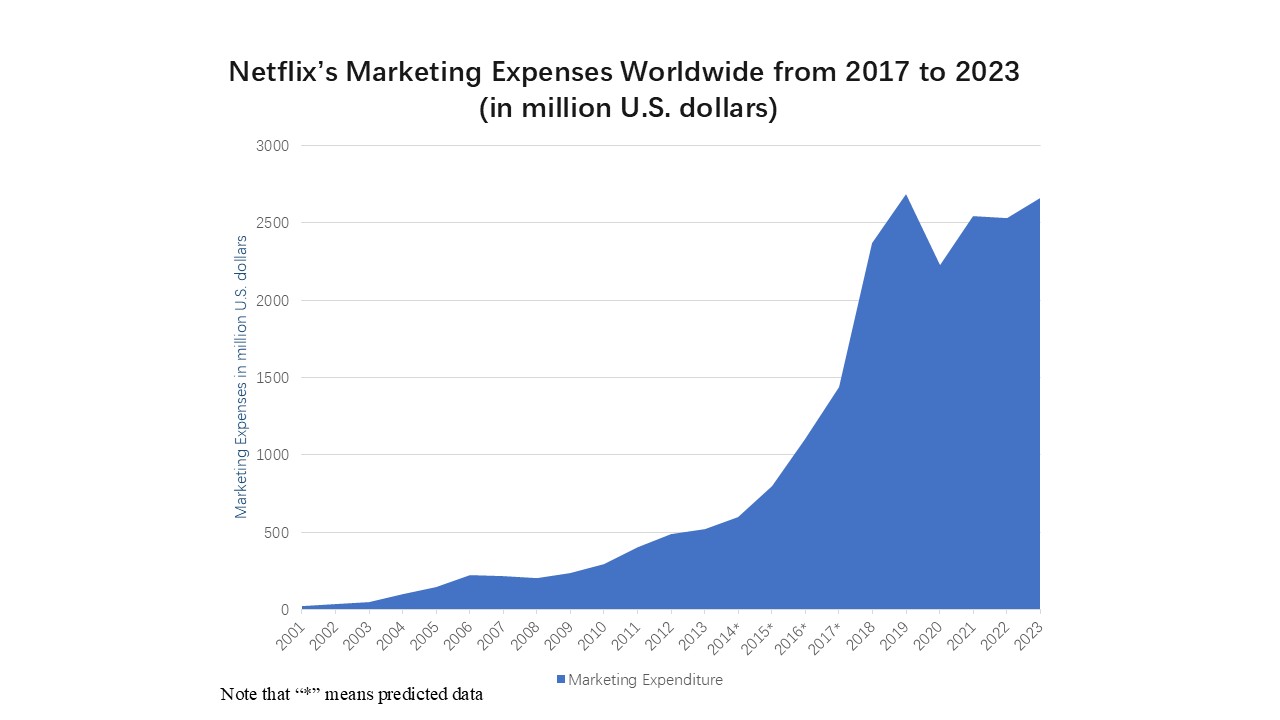

3. Effective Marketing & Promotion: Acquiring New Subscribers

Netflix values marketing and promotion, continuously increasing its investment in this area. Since 2016, Netflix's marketing expenses have increased significantly that year, exceeding $1 billion, in response to a trend in advertising and marketing expenses that was flat compared to previous years. And then, after just two years, Netflix's marketing expenses surpassed the $2 billion mark in 2018—a double increase in marketing expenses in two years. More than $2 billion, such a great amount of money, has been consistently invested to marketing and promotion by Netflix in the past five years annually. Netflix has spent $2.6 billion on marketing in the year of 2023, and its investment channels and developing innovative investment strategies has been expanded constantly.

To entice users to buy services, Netflix frequently employs a variety of marketing platforms. While paid search listings, banner ads, email ads, text on well-known websites and portals, placing products on television shows or mainstream websites across the globe, putting ads in the packaging of a range of consumer goods, word-of-mouth ads, and active public relations campaigns are all crucial components of Netflix's marketing strategy, online advertising is a key way for the streaming service to draw in new members.

Netflix has consistently considered marketing as a fundamental technique to attract new subscribers. Netflix’s annual report on 2002 indicates that marketing efforts augmented new subscriber trials by more than 101% compared to the previous year. The annual reports of the firm for 2020 and 2004 indicate that marketing efforts resulted in a 74% and 85% year-over-year rise in Netflix new subscriber trials, respectively.

2020-2022: Subscription Addition Declined

Although an annual increase in Netflix's total subscribers has shown in the line chart, it also presents a drop in the addition of paid subscribers from 2020 to 2022. Three reasons contribute to explain this decrease:

1. Impact of the Pandemic

The COVID-19, which began in Q4 of 2019, brought much uncertainty and turmoil. For the sake of employees' personal safety and health, almost all of them worked at home, which affected work efficiency and communication; international travel was hindered, which prevented some projects from being carried out smoothly; the economy was shut down due to the domestic and international situation, and factories were shut down, and some third-party suppliers went bankrupt due to the impact of the epidemic as well as other partners responsible for operations, content development, and post-production.

All of these factors contributed to Netflix's overall supply constraints and increased production costs, resulting in production delays and a decrease in new services and content. In a chain reaction, it was difficult to maintain the original level of content delivery, which ultimately resulted in the loss of new subscribers. According to Netflix's official financial report, the significant drop in investment in content in 2020 (a sharp reduction of $2 billion in investment) confirms this statement.

- Statista | Content spending of Netflix worldwide from 2012 to 2024

2. Challenge from Competitors

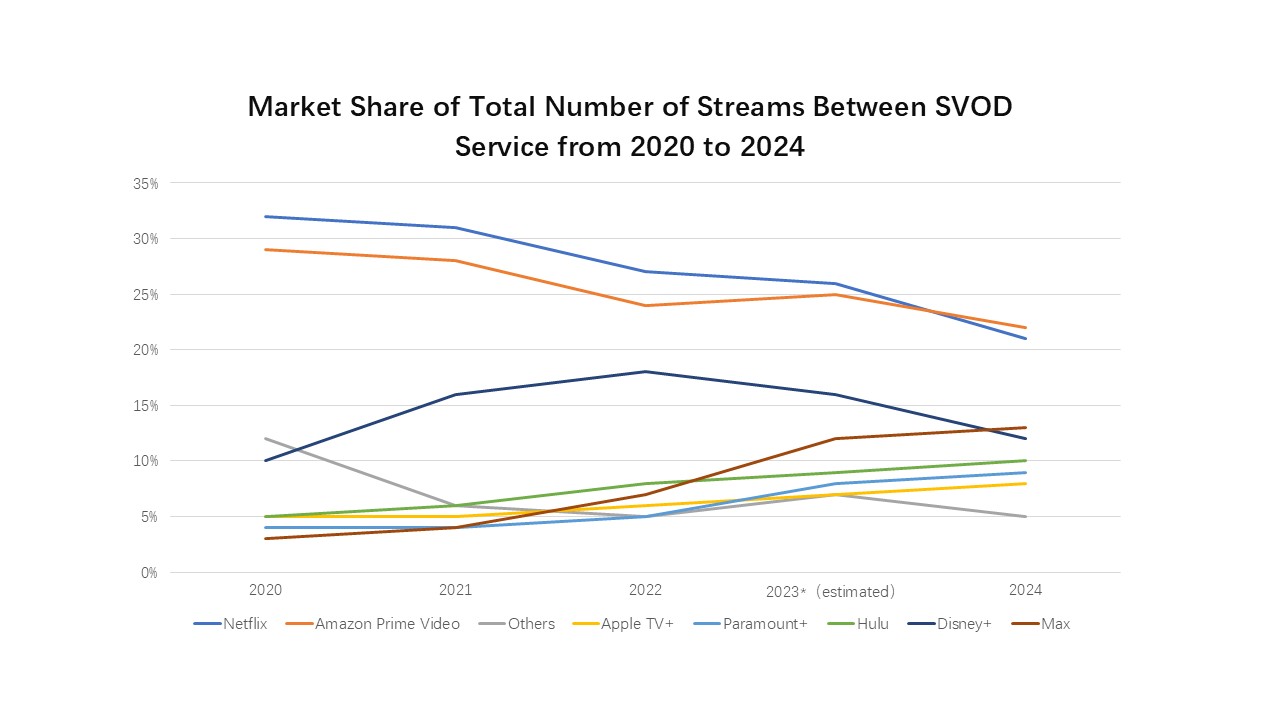

The pandemic has ushered in an era of intensifying competition within the streaming service industry and a burgeoning electronic gaming sector. Netflix had to deal with a lot of tough competition from other entertainment video companies, streaming services (that showed illegal videos), online games, and anyone else who might want to spend their free time watching videos.

JustWatch statistics shows that Netflix's market share has gone down from 32% in 2020 to 21% in 2024. Other streaming services, like Max, Hulu, and Paramount+, have seen their market numbers grow, on the other hand. In the United States, Max's market share has tripled in five years, going from 3% to 13%. Hulu's market share has also doubled, going from 5% to 10%. In the same way, Paramount+ has almost doubled in size from 2020 to 2024, rising from 4% to 9%.

3. Individual Factors

- Job and school closures in many regions and countries caused by pandemic has resulted in lower job employment and then less income. Subsequently, the household, especially the part for subscription cost, has been cut down.

- Customers are reluctant to renew subscriptions because of the disappointing customer service.

- Content dissatisfaction has made people reluctant to subscribe.

2022–2023: Rebounds in Subscription Growth

- Statista | Paid net subscriber additions of Netflix worldwide from 2014 to 3rd quarter 2024

The chart clearly shows that Netflix's subscriber growth has resumed its upward trend, regaining its vitality, starting from 2023. So, what kind of business strategy has enabled Netflix to “be great again”?

1. High-Quality Blockbusters Attract Subscribers

Netflix released a list titled What We Watched: a Netflix Engagement Report in December, 2023. Viewed hours is taken as evaluation criteria. This report covered more than 18,000 movies and represented 99% of all Netflix views. It frankly shows that the top 20 titles all released in late 2022 and early 2023, with influential titles drawing in new subscribers.

|

Title |

Available Globally? |

Release Date |

Hours Viewed |

|

|

1 |

The Night Agent: Season 1 |

Yes |

2023/3/23 |

812,100,000 |

|

2 |

Ginny & Georgia: Season 2 |

Yes |

2023/1/5 |

665,100,000 |

|

3 |

The Glory: Season 1 // 더 글로리: 시즌 1 |

Yes |

2022/12/30 |

622,800,000 |

|

4 |

Wednesday: Season 1 |

Yes |

2022/11/23 |

507,700,000 |

|

5 |

Queen Charlotte: A Bridgerton Story |

Yes |

2023/5/4 |

503,000,000 |

|

6 |

You: Season 4 |

Yes |

2023/2/9 |

440,600,000 |

|

7 |

La Reina del Sur: Season 3 |

No |

2022/12/30 |

429,600,000 |

|

8 |

Outer Banks: Season 3 |

Yes |

2023/2/23 |

402,500,000 |

|

9 |

Ginny & Georgia: Season 1 |

Yes |

2021/2/24 |

302,100,000 |

|

10 |

FUBAR: Season 1 |

Yes |

2023/5/25 |

266,200,000 |

|

11 |

Manifest: Season 4 |

Yes |

2022/11/4 |

262,600,000 |

|

12 |

Kaleidoscope: Limited Series |

Yes |

2023/1/1 |

252,500,000 |

|

13 |

Firefly Lane: Season 2 |

Yes |

2022/12/2 |

251,500,000 |

|

14 |

The Mother |

Yes |

2023/5/12 |

249,900,000 |

|

15 |

Physical: 100: Season 1 // 피지컬: 100: 시즌 1 |

Yes |

2023/1/24 |

235,000,000 |

|

16 |

Crash Course in Romance: Limited Series // 일타 스캔들: 리미티드 시리즈 |

Yes |

2023/1/14 |

234,800,000 |

|

17 |

Love Is Blind: Season 4 |

Yes |

2023/3/24 |

229,700,000 |

|

18 |

BEEF: Season 1 |

Yes |

2023/4/6 |

221,100,000 |

|

19 |

The Diplomat: Season 1 |

Yes |

2023/4/20 |

214,100,000 |

|

20 |

Luther: The Fallen Sun |

Yes |

2023/3/10 |

209,700,000 |

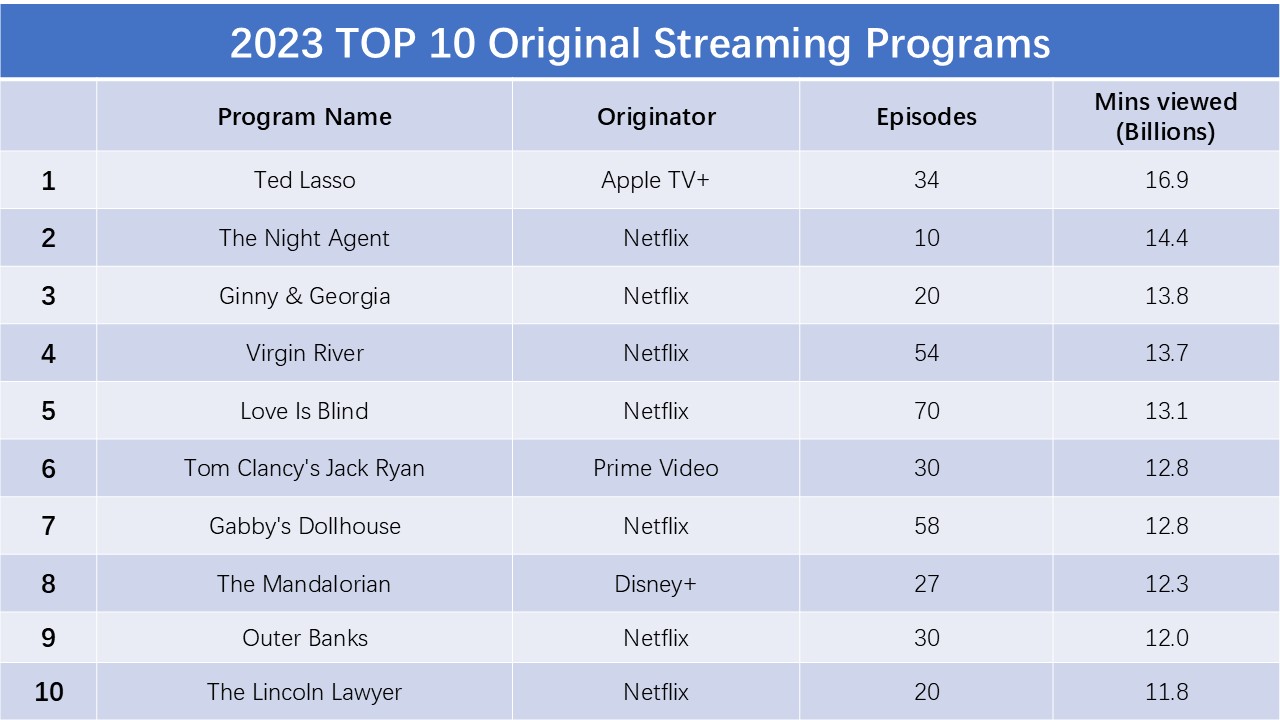

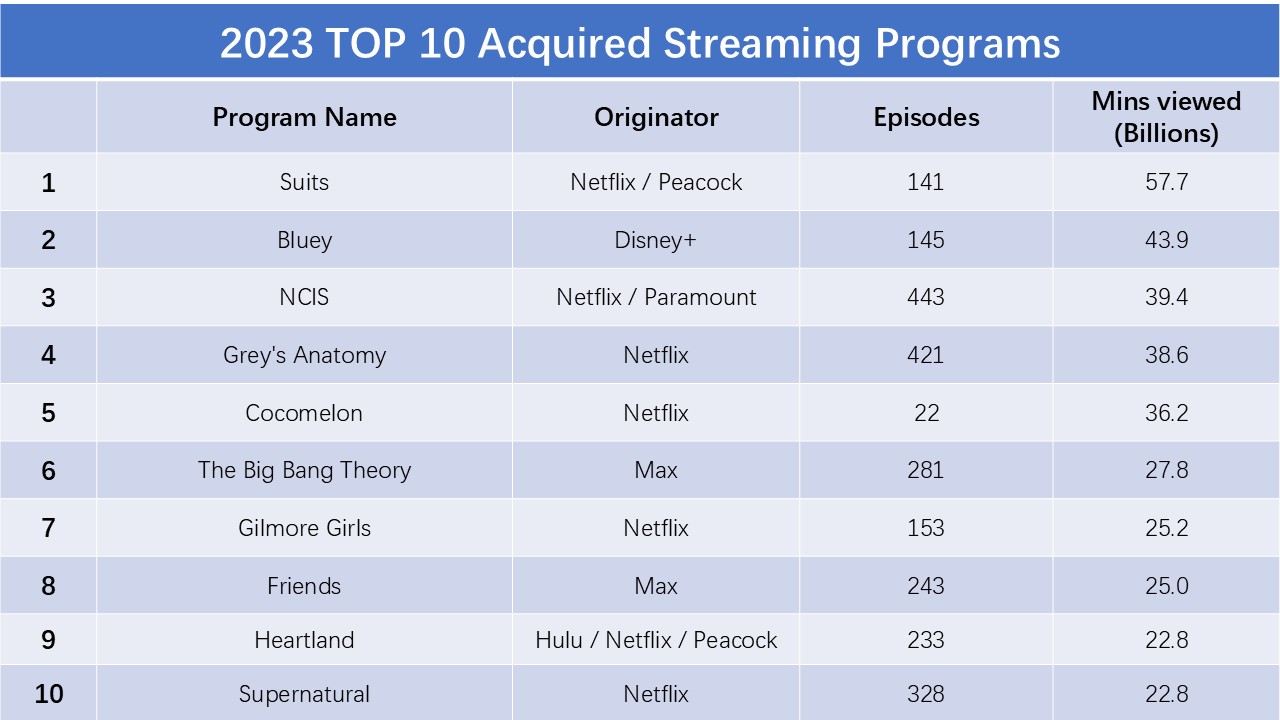

Using the top 10 best-rated TV and movie programs in the U.S. region released by Nielsen in 2023 as an example, Netflix has dominated both the original content field and the acquired content field, boasting seven productions. Overall, users have been attracted and by Netflix’s high-quality content.

2. Account Sharing Policy Boosts Consumption

Netflix announced in February 2023 a change in its account-sharing policy, which had no geographic restrictions, to one that only allows people living in the same household to share platforms and passwords.People predicted that this policy might lead to a "wave of unsubscribes," but eventually Netflix successfully acquired new subscribers and retained longtime users by continuing to invest in content and providing customers premium content.

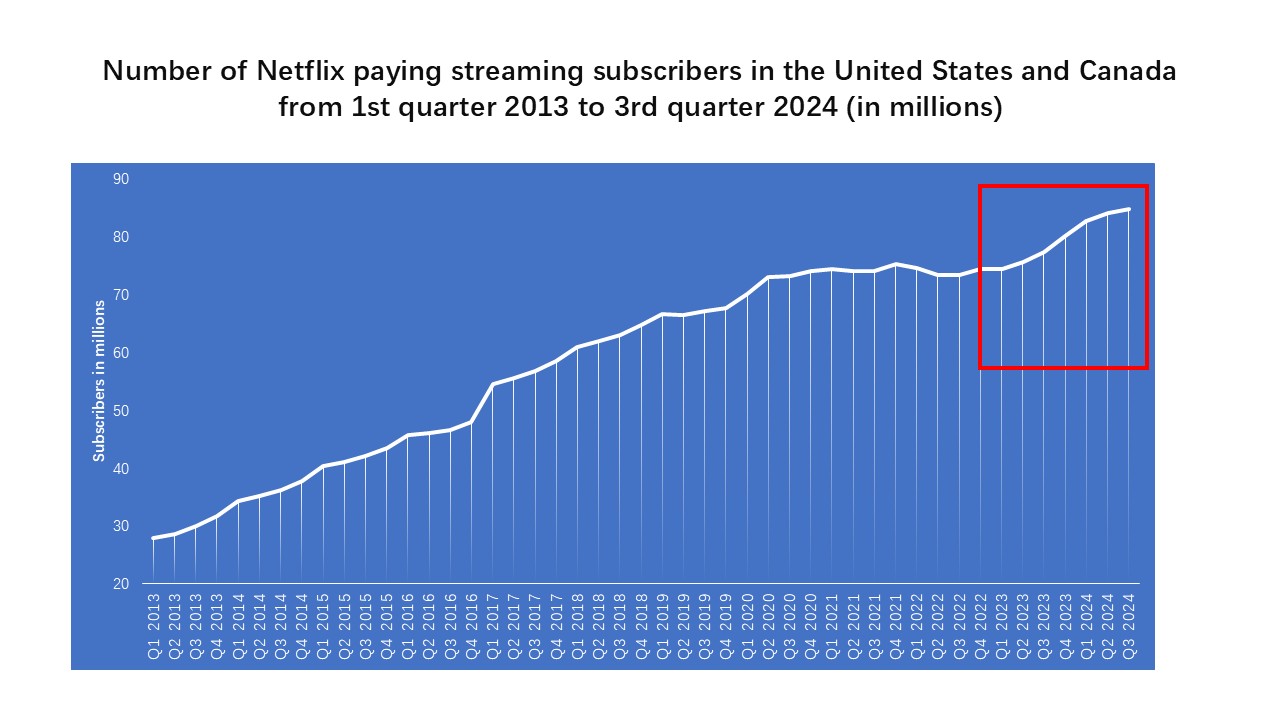

In the end, Netflix added 6 million new subscribers in the second quarter of 2023, including more than 1 million in the U.S. and Canada. In the third quarter of 2023, Netflix added 8.8 million new subscribers—up significantly from 2.4 million new subscribers in the third quarter of 2022—and increased revenue by $64 million.

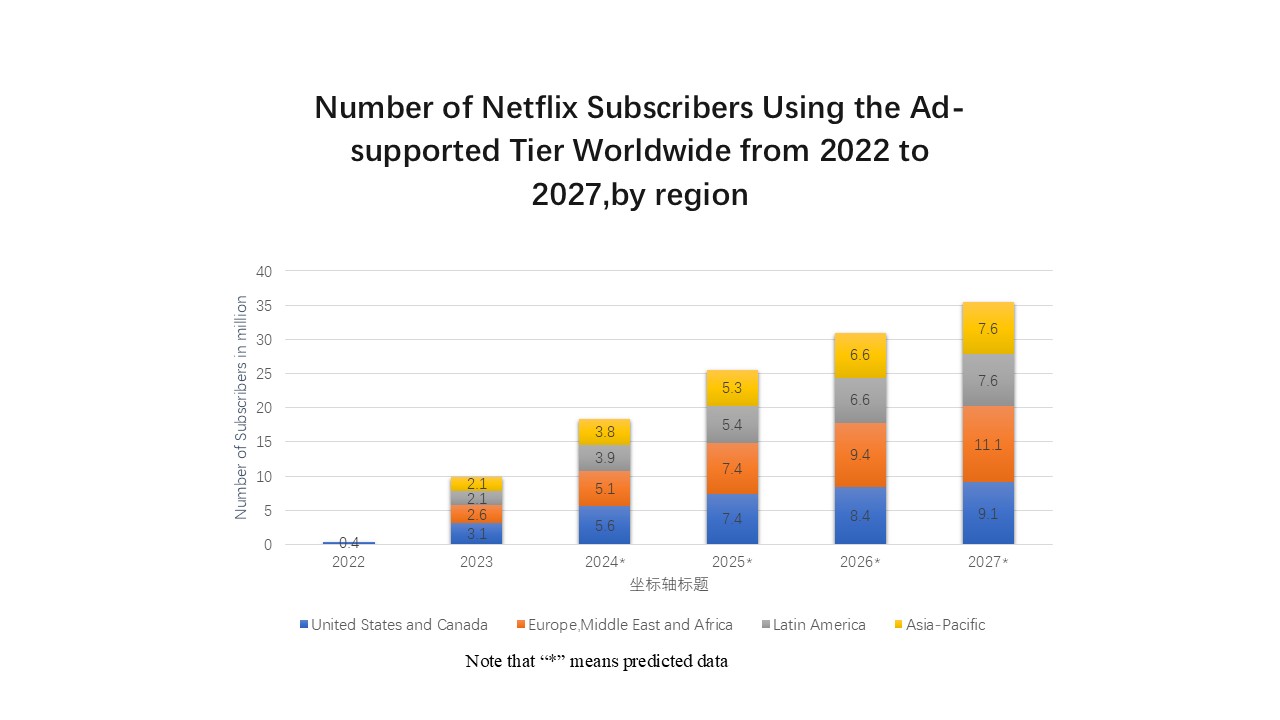

3. Low-Cost Ad-Supported Package Lifts Subscriber Growth

Netflix's subscriber base experienced a rebound in October 2022, as it abandoned its 20-year-old no-advertisement model and introduced the AVOD (Advertising-Based Video on Demand) subscription program. This low-cost option includes advertisements.

For example, on October 19, Netflix adjusted the price in the U.S. market, establishing the standard package without ads at $15.49/month, the premium package (4K support) at $22.99/month, and the package with ads at $6.99/month. If customers agree with this plan, they can save money on Netflix. This change indicates a substantial price disparity between the advertised and non-advertised subscriptions. A substantial number of advertising package subscribers are attracted to the price differential.

Netflix's ad membership increased by 70% from the previous quarter, as indicated by the data provided in the company's annual report for the third quarter of 2023. The incremental subscriber base of the company was considerably increased by the approximately 30% of new subscribers who opted for the ad subscription plan in the third quarter. Additionally, the number of advertising members has consistently increased in terms of subscriptions across regions.

Take Netflix's plan in India as an example, When Netflix first entered the Indian market, it faced several challenges such as stiff competition from local players, high data costs, and limited internet penetration. However, it has since managed to grow its customer base by introducing region-specific content and offering customized subscription plan. The ultimate opening up of the India market has contributed significantly to the growth of Netflix's subscriber base in the Asia-Pacific region.

2025 Outlook: How Will Netflix Subscribers Develop?

The subscription data for the first three quarters of 2024 reveals that Netflix's subscriber base continued to grow in 2024, surpassing 280 million subscriptions in the third quarter. Quarter-over-quarter growth of more than 5 million was observed in each of the first three quarters of 2024, and year-over-year growth in Netflix subscribers for each quarter of 2024, compared to 2023, was 15%, 16%, 14%, and 5%, 8%, 10%, and 6%, 5%, and 4%, respectively, indicating strong growth. In 2024, Netflix's subscriber base increased by 14% compared to 2023, signifying a robust growth trend. Besides,Netflix announced that it will raise the price in 2024 which may push Netflix to continue investing on original content. As a result, more subscribers might be attracted by high-quality content.

We anticipate that Netflix's customer base will persist in its growth, potentially exceeding 300 million subscribers by 2025, while constantly securing a significant portion of the streaming services market.

- Statista | Number of Netflix paid subscribers worldwide from 1st quarter 2013 to 3rd quarter 2024

- Netflix | Annual Report & Proxies Some of the data in this article comes from Netflix's annual report from 2002 to 2023