How to Download Amazon Prime Video to PC/Mobile: A Practical Guide

Summary: This comprehensive guide explains different methods to download Amazon Prime Video content on mobile phones and pc devices. With detailed steps, pros and cons, and FAQs, the article helps users choose the best method tailored to their viewing habits and needs.

Recently, I was preparing for a long trip where internet connectivity might be unreliable—on planes, trains, or cars. I started exploring how to legally download Amazon Prime videos to watch offline.

While many articles cover this topic, few clearly explain the limitations or share firsthand experience with third-party tools that expand download possibilities. In this guide, I’ll walk you through official and advanced methods, testing their pros and cons, so you can pick the best solution tailored to your needs.

Can You Download Amazon Movies and Shows?

Yes, Amazon Prime Video offers users the function to download content. You can utilize the official app to download purchased video, rented movies, and Prime member-included original videos. For videos that are not downloadable through the official platform, you may seek assisants based on my best Amazon downloaders review.

Here is an overview and comparison of the methods for downloading Amazon Prime movies on your computer. You can click on them to navigate to the respective sections.

| Ratings | Content | Time Expiration | Format | Auto-download mode | |

|---|---|---|---|---|---|

| Amazon Prime Video Official App | ⭐⭐⭐ | Limited purchased and rented movies and originals | 48-hour/30-day | DRM-protected format | NO |

| StreamFab Amazon Downloader | ⭐⭐⭐⭐⭐ | Download any prime videos without limits | Never | Standard MP4/MKV format | YES |

Method 1: Download Amazon Prime Videos with Official App

In order to watch and download Amazon Prime videos, you need to create an Amazon account first with your name, E-mail, password, and credit card information. Then, go ahead for Amazon Prime to sign in.

This app offers a 30-day free trial, after which you will be charged $8.99 a month. If you don’t want to pay a bill, just cancel the auto-pay 24 hours before the deadline.

This method is ideal for downloading prime videos during short trips.

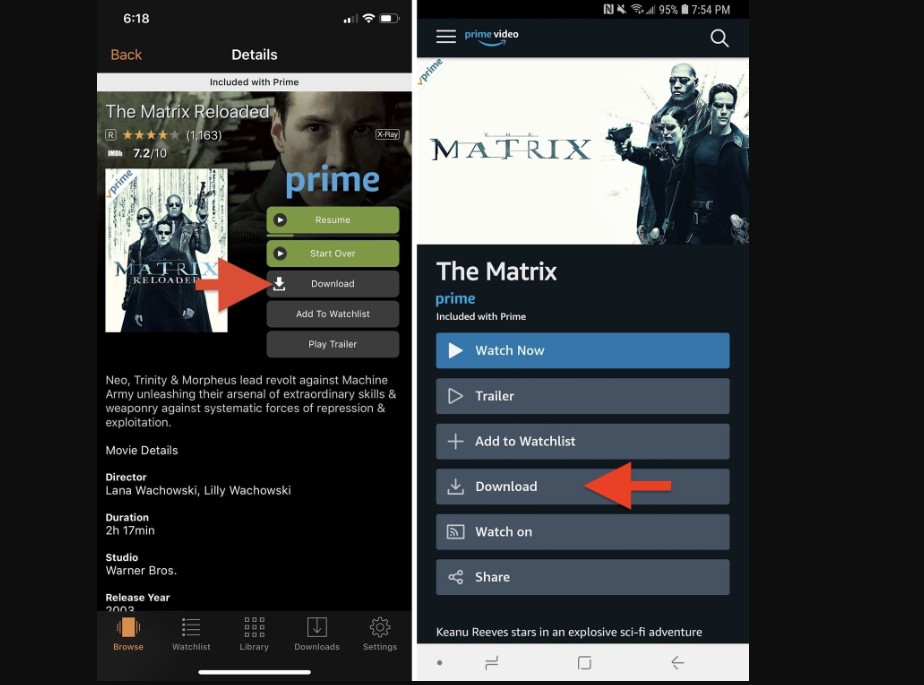

Steps to download Amazon Prime videos via the official app:

Amazon Prime Video officially supports downloading a selection of movies and shows for offline viewing via mobile apps. These downloads include purchased titles, rentals, and included Prime Originals.

However, Amazon Prime video download limits in terms of content availability, maximum number of titles, playback time limits, and device restrictions cannot be bypassed via this method. Many popular titles remain non-downloadable through the official app.

- Safe, official support and regularly updated app.

- Simple interface requiring no technical skills.

- Only mobile devices supported; no official PC downloads.

- Download expiration: videos expire 48 hours to 30 days after download.

- Maximum 15-25 titles limit.

- DRM-encrypted files playable only inside the app.

- Downloads inaccessible outside supported regions or after subscription ends.

For users seeking permanent, unrestricted access to their favorite videos, official downloads may feel limiting. That’s why I also choosed a powerful alternative—StreamFab Amazon Downloader—and will share my experience below.

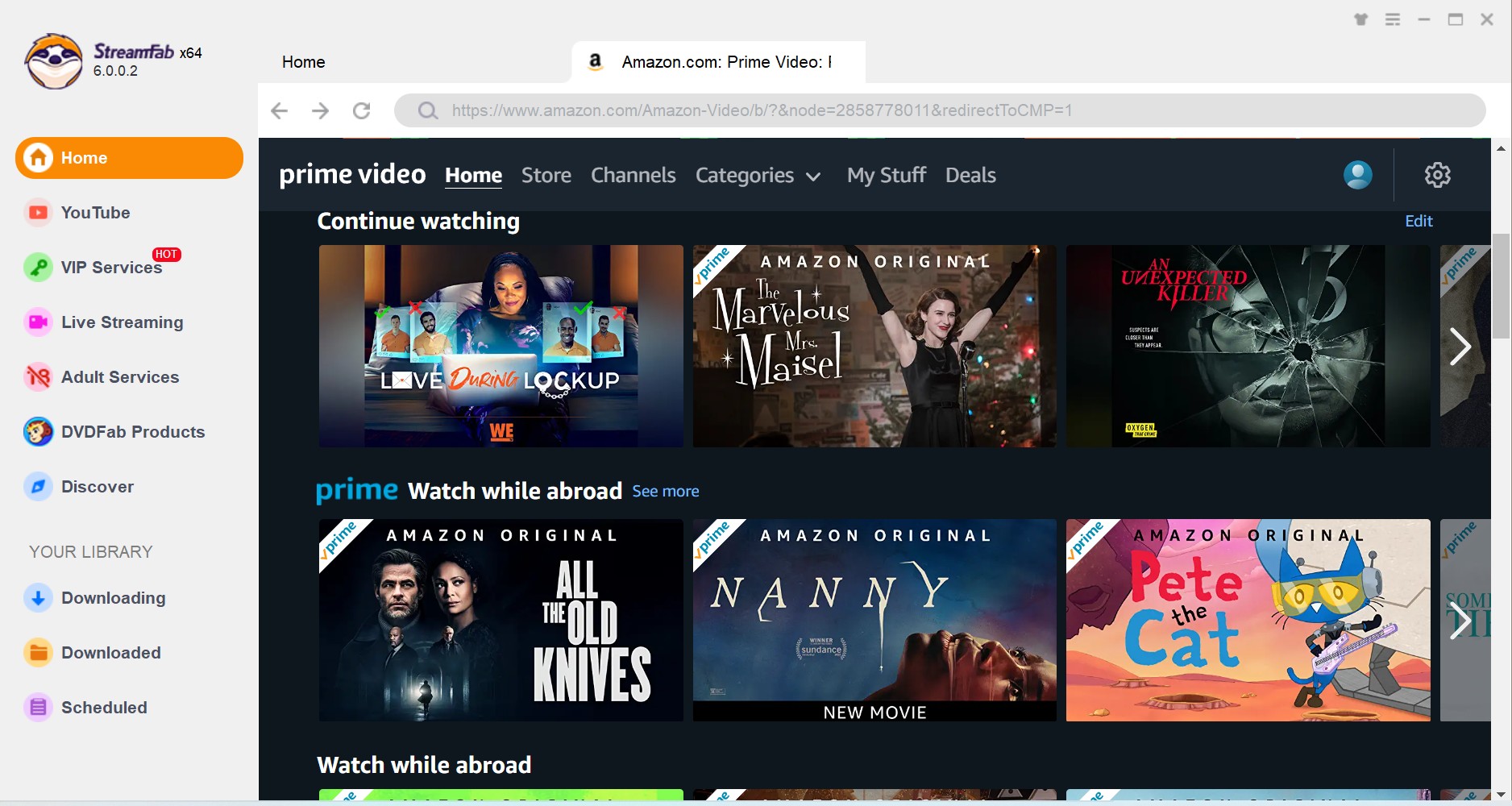

Method 2: Use StreamFab to Download Amazon Prime Videos Without Expiration

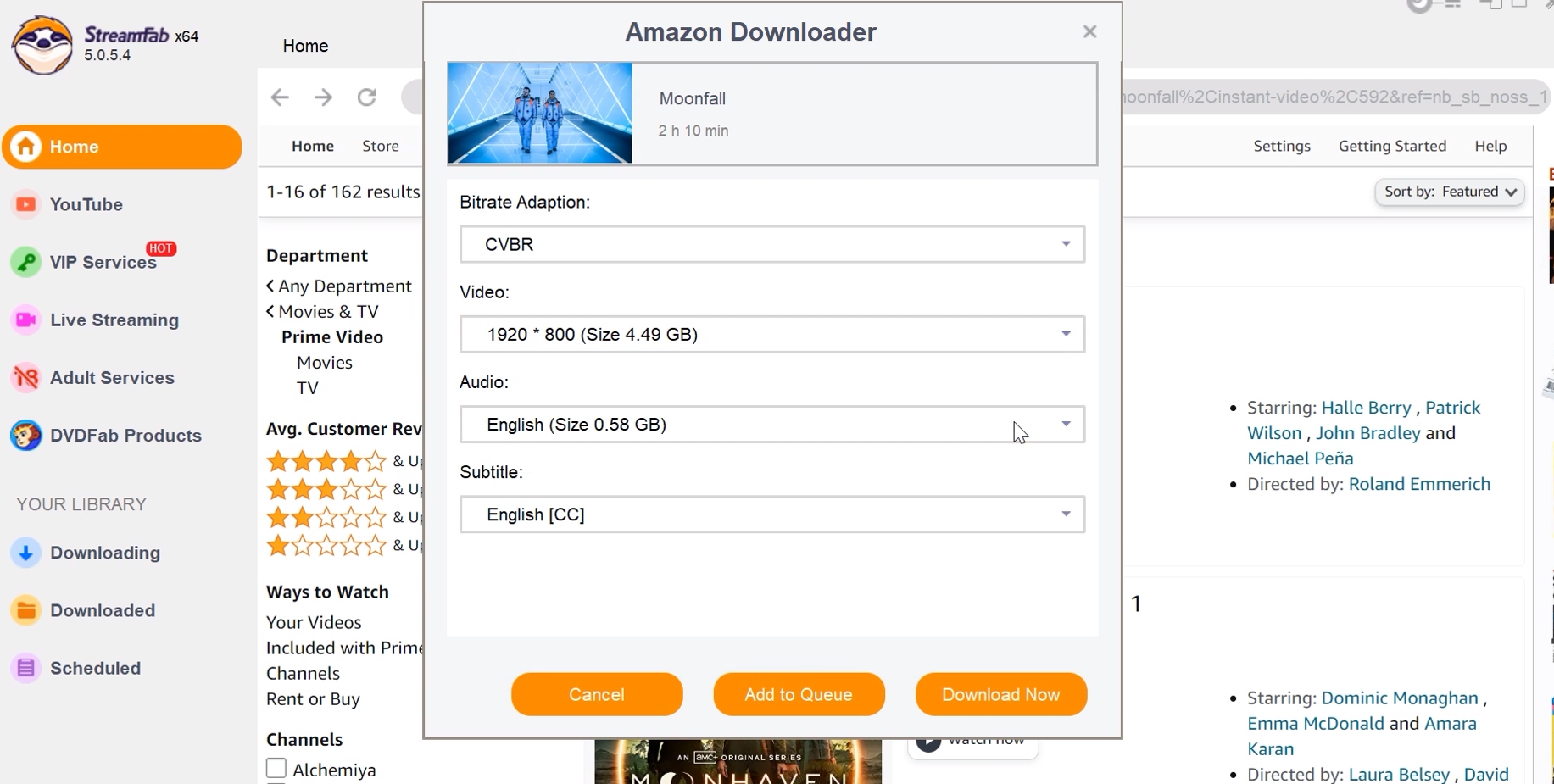

To download Amazon Prime videos in regular mp4/mkv format, you can select StreamFab Amazon Downloader. By removing Amazon DRM protection, it also preserves the native lossless 1080P high definition quality and EAC3 5.1 audio track.

You can use a local media player to watch amazon prime video offline, and the downloaded content never expires. Even after your Amazon subscription period ends, you can always watch the videos you have downloaded.

Tool Required: StreamFab Amazon Downloader

This method is ideal for frequent travelers needing reliable offline access, users wanting to archive Amazon videos permanently, and those seeking more flexibility than the official app offers.

Effortlessly download any Amazon Prime videos for offline watching in lossless quality abd save the Amazon videos on your device permanently without expiration.

- Get ad-free Amazon video downloads even if you are ad-supported Prime member.

- Unlimited Prime video downloads with 1080p resolution & EAC3 5.1 or AAC 2.0 audio track.

- Downloading Amazon videos with H.264 or H.265 codecs to save your device storage space.

- Download Amazon Prime Video to MP4 for flexible access on any device.

- Get Prime video downloads with your best-suited subtitles & metadata.

- Scheduled newly released videos will be automatically downloaded from Amazon Prime video.

Operation Steps

StreamFab Amazon Downloader offers 3 chance to download prime videos for free during trial, you can enjoy the free chance before your final decision:

FAQ

Please ensure that your Amazon application is up to date, and that your subscribed plan includes the download feature. Also, be aware that not all videos on Amazon are available for download. If you wish to download videos that do not support offline viewing, we recommend using StreamFab Amazon Downloader.

The videos on Amazon are all protected by DRM. If you wish to download bonus videos or purchased video in MP4 format, you will need to utilize the professional tools like StreamFab.

The default location for downloading on the PC is the C: drive. You cannot set the video quality and Prime Video download location within the PC application. If you wish to save videos to a different disk, you should manually adjust the system storage in the "Settings" module on your computer.

If you do not make any changes, you will find the downloaded videos in the following folder:

C:\Users\UserName\AppData\Local\Packages\AmazonVideo.PrimeVideo_pwbj9vvecjh7j\ LocalState\Downloads.

Conclusion

Drawing from my personal trial and extensive research:

- Use the official Amazon Prime Video app for quick, straightforward downloads if you only need offline access occasionally.

- Choose StreamFab Amazon Downloader for a long-term solution that offers unlimited, DRM-free, permanent downloads in versatile formats.

I hope you can get a clear, user-centered insight and tested options in this article to download Amazon Prime videos. Feel free to share your experience or ask questions in the comments!